Avoiding Scams

International scam artists use clever schemes to defraud millions of people

around the globe each year, threatening financial security and generating

substantial profits for criminal organizations and common crooks. Being on guard

online can help you maximize the benefits of e-commerce and minimize your chance

of being defrauded. Here are ten tips to help you avoid common online scams:

- Don’t send money to someone you don’t know. That

includes an online merchant you’ve never heard of — or an online love

interest who asks for money or favors. It’s best to do business with sites

you know and trust. If you buy items through an online auction, consider a

payment option that provides protection, like a credit card. Don’t send cash

or use a wire transfer service. And don’t pay upfront fees for the promise

of a big pay-off — whether it’s a loan, a job, or prize money.

- Don’t respond to messages that ask for your personal or

financial information, whether the message comes as an email, a phone call,

a text message, or an ad. Don’t

click on links or call phone numbers included in the message, either. The

crooks behind these messages are trying to trick you into sending money and

revealing your bank account information. If you get a message and are

concerned about your account status, call the number on your credit or debit

card — or your statement — and check it out.

- Don’t play a foreign lottery. First,

it’s easy to be tempted by messages that boast enticing odds in a foreign

lottery, or messages that claim you’ve already won. Inevitably, you’ll be

asked to pay “taxes,” “fees,” or “customs duties” to collect your prize. If

you send money, you won’t get it back, regardless of the promises. Second,

it’s illegal to play foreign lotteries.

- Keep in mind that wiring money is like sending cash: once it’s

gone, you can’t get it back. Con

artists often insist that people wire money, especially overseas, because

it’s nearly impossible to reverse the transaction or trace the money. Don’t

wire money to strangers, to sellers who insist on wire transfers for

payment, or to someone who claims to be a relative in an emergency (and

wants to keep the request a secret).

- Don’t agree to deposit a check from someone you don’t know and

then wire money back, no matter how convincing the story. By

law, banks must make funds from deposited checks available within days, but

uncovering a fake check can take weeks. You are responsible for the checks

you deposit: When a check turns out to be a fake, you’ll be responsible for

paying back the bank.

- Read your bills and monthly statements regularly—on paper and

online. Scammers steal

account information and then run up charges or commit crimes in your name.

Dishonest merchants sometimes bill you for monthly “membership fees” and

other goods or services you didn’t authorize. If you see charges you don’t

recognize or didn’t okay, contact your bank, card issuer, or other creditor

immediately.

- In the wake of a natural disaster or another crisis, give to

established charities rather than ones that seem to have sprung up

overnight. Pop-up charities probably don’t have the infrastructure

to get help to the affected areas or people, and they could be collecting

the money to finance illegal activity. Check out ftc.gov/charityfraud to

learn more.

- Talk to your doctor before buying health products or signing up

for medical treatments. Ask

about research that supports a product’s claims — and possible risks or side

effects. Buy prescription drugs only from licensed U.S. pharmacies.

Otherwise, you could end up with products that are fake, expired or

mislabeled — in short, products that could be dangerous. Visit ftc.gov/health for

more information.

- Remember there’s no such thing as a sure thing. If

someone contacts you promoting low-risk, high-return investment

opportunities, stay away. When you hear pitches that insist you act now,

guarantees of big profits, promises of little or no financial risk, or

demands that you send cash immediately, report them at ftc.gov.

- Know where an offer comes from and who you’re dealing with. Try

to find a seller’s physical address (not just a P.O. Box) and phone number.

With VoIP and other web-based technologies, it’s tough to tell where someone

is calling from. Do an internet search for the company name and website and

look for negative reviews. Check them out with the Better Business Bureau at bbb.org.

10 Scams to Screen from Your Email

While some consumers find unsolicited commercial email – also known as "spam"

– informative, others find it annoying and time consuming. Still others find it

expensive: They're among the people who have lost money to spam that contained

bogus offers and fraudulent promotions.

Many Internet Service Providers and computer operating systems offer

filtering software to limit the spam in their users' email inboxes. In addition,

some old-fashioned 'filter tips' can help you save time and money by avoiding

frauds pitched in email. OnGuard Online wants computer users to screen spam for

scams, send unwanted spam on to the appropriate enforcement authorities, and

then hit delete. Here's how to spot 10 common spam scams:

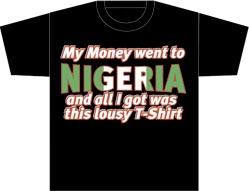

1. The "Nigerian" Email Scam

The Bait: Con artists claim to be officials, businesspeople,

or the surviving spouses of former government honchos in Nigeria or another

country whose money is somehow tied up for a limited time. They offer to

transfer lots of money into your bank account if you will pay a fee or "taxes"

to help them access their money. If you respond to the initial offer, you may

receive documents that look "official." Then they ask you to send money to cover

transaction and transfer costs and attorney's fees, as well as blank letterhead,

your bank account numbers, or other information. They may even encourage you to

travel to the country in question, or a neighboring country, to complete the

transaction. Some fraudsters have even produced trunks of dyed or stamped money

to try to verify their claims.

The Catch: The emails are from crooks trying to steal your

money or your identity. Inevitably, in this scenario, emergencies come up,

requiring more of your money and delaying the "transfer" of funds to your

account. In the end, there aren't any profits for you, and the scam artist

vanishes with your money. The harm sometimes can be felt even beyond your

pocketbook: according to State Department reports, people who have responded to

"pay in advance " solicitations have been beaten, subjected to threats and

extortion, and in some cases, murdered.

Your Safety Net: If you receive an email from someone

claiming to need your help getting money out of a foreign country, don't

respond. Forward "Nigerian" scams – including all the email addressing

information – to spam@uce.gov.

If you've lost money to one of these schemes, call your local Secret Service

field office. Local field offices are listed in the Blue Pages of your telephone

directory.

2. Phishing

The Bait: Email or pop-up messages that claim to be from a

business or organization you may deal with – say, an Internet Service Provider

(ISP), bank, online payment service, or even a government agency. The message

may ask you to "update," "validate," or "confirm" your account information or

face dire consequences.

The Catch: Phishing is a scam where internet fraudsters send

spam or pop-up messages to reel in personal and financial information from

unsuspecting victims. The messages direct you to a website that looks just like

a legitimate organization's site, or to a phone number purporting to be real.

But these are bogus and exist simply to trick you into divulging your personal

information so the operators can steal it, fake your identity, and run up bills

or commit crimes in your name.

Your Safety Net: Make it a policy never to respond to emails

or pop-ups that ask for your personal or financial information, click on links

in the message, or call phone numbers given in the message. Don't cut and paste

a link from the message into your Web browser, either: phishers can make links

look like they go one place, but then actually take you to a look-alike site. If

you are concerned about your account, contact the organization using a phone

number you know to be genuine, or open a new internet browser session and type

in the company's correct Web address yourself. Using anti-virus and anti-spyware

software and a firewall, and keeping them up to date, can help.

Forward phishing emails to spam@uce.gov and

to the organization that is being spoofed.

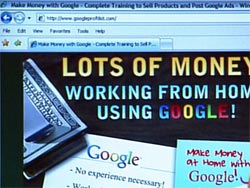

3. Work-at-Home Scams

The Bait: Advertisements that promise steady income for minimal

labor – in medical claims processing, envelope-stuffing, craft assembly work, or

other jobs. The ads use similar come-ons: Fast cash. Minimal work. No risk. And

the advantage of working from home when it's convenient for you.

The Catch: The ads don't say you may have to work many hours

without pay, or pay hidden costs to place newspaper ads, make photocopies, or

buy supplies, software, or equipment to do the job. Once you put in your own

time and money, you're likely to find promoters who refuse to pay you, claiming

that your work isn't up to their "quality standards."

Your Safety Net: The FTC has yet to find anyone who has

gotten rich stuffing envelopes or assembling magnets at home. Legitimate

work-at-home business promoters should tell you – in writing – exactly what's

involved in the program they're selling. Before you commit any money, find out

what tasks you will have to perform, whether you will be paid a salary or work

on commission, who will pay you, when you will get your first paycheck, the

total cost of the program – including supplies, equipment and membership fees –

and what you will get for your money. Can you verify information from current

workers? Be aware of "shills," people who are paid to lie and give you every

reason to pay for work. Get professional advice from a lawyer, an accountant, a

financial advisor, or another expert if you need it, and check out the company

with your local consumer protection agency, state Attorney General and the

Better Business Bureau – not only where the company is located, but also where

you live.

Forward work-at-home scams to spam@uce.gov.

4. Weight Loss Claims

The Bait: Emails promising a revolutionary pill, patch,

cream, or other product that will result in weight loss without diet or

exercise. Some products claim to block the absorption of fat, carbs, or

calories; others guarantee permanent weight loss; still others suggest you'll

lose lots of weight at lightning speed.

The Catch: These are gimmicks, playing on your sense of

hopefulness. There's nothing available through email you can wear or apply to

your skin that can cause permanent, or even significant weight loss.

Your Safety Net: Experts agree that the best way to lose

weight is to eat fewer calories and increase your physical activity so you burn

more energy. A reasonable goal is to lose about a pound a week. For most people,

that means cutting about 500 calories a day from your diet, eating a variety of

nutritious foods, and exercising regularly. Permanent weight loss happens with

permanent lifestyle changes. Talk to your health care provider about a nutrition

and exercise program suited to your lifestyle and metabolism.

Forward weight loss emails to spam@uce.gov.

5. Foreign Lotteries

The Bait: Emails boasting enticing odds in foreign

lotteries. You may even get a message claiming you've already won! You just have

to pay to get your prize or collect your winnings.

The Catch: Most promotions for foreign lotteries are phony.

The scammers will ask you to pay "taxes," "customs duties," or "fees" – and then

keep any money you send. Scammers sometimes ask you to send funds via wire

transfer. Don't send cash or use a money-wiring service because you'll have no

recourse if something goes wrong. In addition, lottery hustlers use victims'

bank account numbers to make unauthorized withdrawals or their credit card

numbers to run up additional charges. And one last important note: participating

in a foreign lottery violates U.S. law.

Your Safety Net: Skip these offers. Don't send money now on

the promise of a pay-off later.

Forward solicitations for foreign lottery promotions to spam@uce.gov.

6. Cure-All Products

The Bait: Emails claiming that a product is a "miracle cure," a

"scientific breakthrough," an "ancient remedy," or a quick and effective cure

for a wide variety of ailments or diseases. They generally announce limited

availability, and require payment in advance, and offer a no-risk "money-back

guarantee." Case histories or testimonials by consumers or doctors claiming

amazing results are not uncommon.

The Catch: There is no product or dietary supplement

available via email that can make good on its claims to shrink tumors, cure

insomnia, cure impotency, enlarge body parts, treat Alzheimer's disease, or

prevent severe memory loss. These kinds of claims deal with the treatment of

diseases; companies that want to make claims like these must follow the FDA's

pre-market testing and review process required for new drugs.

Your Safety Net: When evaluating health-related claims, be

skeptical. Consult a health care professional before buying any "cure-all" that

claims to treat a wide range of ailments or offers quick cures and easy

solutions to serious illnesses. Generally speaking, a cure all is a cure none.

Forward spam with miracle health claims to spam@uce.gov.

7. Check Overpayment Scams

The Bait: A response to your ad or online auction posting,

offering to pay with a cashier's, personal, or corporate check. At the last

minute, the so-called buyer (or the buyer's "agent") comes up with a reason for

writing the check for more than the purchase price, and asks you to wire back

the difference after you deposit the check.

The Catch: If you deposit the check, you lose. Typically,

the checks are counterfeit, but they're good enough to fool unsuspecting bank

tellers and increase the balance in your bank account – temporarily. But when

the check eventually bounces, you are liable for the entire amount.

Your Safety Net: Don't accept a check for more than your

selling price, no matter how tempting the plea or convincing the story. Ask the

buyer to write the check for the purchase price. If the buyer sends the

incorrect amount, return the check. Don't send the merchandise. As a seller who

accepts payment by check, you may ask for a check drawn on a local bank, or a

bank with a local branch. That way, you can visit personally to make sure the

check is valid. If that's not possible, call the bank the check was drawn on

using the phone number from directory assistance or an internet site that you

know and trust, not from the person who gave you the check. Ask if the check is

valid.

Forward check overpayment scams to spam@uce.gov and

your state Attorney General. You can find contact information for your state

Attorney General at www.naag.org.

8. Pay-in-Advance Credit Offers

The Bait: News that you've been "pre-qualified" to get a

low-interest loan or credit card, or repair your bad credit even though banks

have turned you down. But to take advantage of the offer, you have to ante up a

processing fee of several hundred dollars.

The Catch: A legitimate pre-qualified offer means you've

been selected to apply. You still have to complete an application and you can

still be turned down. If you paid a fee in advance for the promise of a loan or

credit card, you've been hustled. You might get a list of lenders, but there's

no loan, and the person you've paid has taken your money and run.

Your Safety Net: Don't pay for a promise. Legitimate lenders

never "guarantee" a card or loan before you apply. They may require that you pay

application, appraisal, or credit report fees, but these fees seldom are

required before the lender is identified and the application is completed. In

addition, the fees generally are paid to the lender, not to the broker or person

who arranged the "guaranteed" loan. Forward unsolicited email containing credit

offers to spam@uce.gov.

9. Debt Relief

The Bait: Emails touting a way you can consolidate your

bills into one monthly payment without borrowing; stop credit harassment,

foreclosures, repossessions, tax levies and garnishments; or wipe out your

debts.

The Catch: These offers often involve bankruptcy

proceedings, but they rarely say so. While bankruptcy is one way to deal with

serious financial problems, it's generally considered the option of last resort.

The reason — it has a long-term negative impact on your creditworthiness. A

bankruptcy stays on your credit report for 10 years, and can hurt your ability

to get credit, a job, insurance, or even a place to live. To top it off, you

will likely be responsible for attorneys' fees for bankruptcy proceedings.

Your Safety Net: Read between the lines when looking at

these emails. Before resorting to bankruptcy, talk with your creditors about

arranging a modified payment plan, contact a credit counseling service to help

you develop a debt repayment plan, or carefully consider a second mortgage or

home equity line of credit. One caution: While a home loan may allow you to

consolidate your debt, it also requires your home as collateral. If you can't

make the payments, you could lose your home.

Forward debt relief offers to spam@uce.gov.

10. Investment Schemes

The Bait: Emails touting "investments" that promise high

rates of return with little or no risk. One version seeks investors to help form

an offshore bank. Others are vague about the nature of the investment, but

stress the rates of return. Promoters hype their high-level financial

connections; the fact that they're privy to inside information; that they'll

guarantee the investment; or that they'll buy it back. To close the deal, they

often serve up phony statistics, misrepresent the significance of a current

event, or stress the unique quality of their offering. And they'll almost always

try to rush you into a decision.

The Catch: Many unsolicited schemes are a good investment

for the promoters, but not for participants. Promoters of fraudulent investments

operate a particular scam for a short time, close down before they can be

detected, and quickly spend the money they take in. Often, they reopen under

another name, selling another investment scam.

Your Safety Net: Take your time in evaluating the legitimacy

of an offer: The higher the promised return, the higher the risk. Don't let a

promoter pressure you into committing to an investment before you are certain

it's legitimate. Hire your own attorney or an accountant to take a look at any

investment offer, too.

Forward spam with investment-related schemes to spam@uce.gov.

Fighting Back

Con artists are clever and cunning, constantly hatching new variations on

age-old scams. Still, skeptical consumers can spot questionable or unsavory

promotions in email offers. Should you receive an email that you think may be

fraudulent, forward it to the FTC at spam@uce.gov,

hit delete, and smile. You'll be doing your part to help put a scam artist out

of work.

How to Report Spam

If you receive an email that you think may be a scam:

- Forward it to the FTC at spam@uce.gov and

to the abuse desk of the sender's ISP.

- Also, if the email appears to be impersonating a bank or other company

or organization, forward the message to the actual organization.

If you think you may have responded to an email that may be a scam:

- File a report with the Federal Trade Commission at www.ftc.gov/complaint.

- Report it to your state Attorney General, using contact information at naag.org.

- Then visit the FTC's identity theft website at ftc.gov/idtheft.

While you can't completely control whether you will become a victim of

identity theft, you can take some steps to minimize your risk.

|